New Year’s Day consistently ranks as one of the busiest order days for Quick Service Restaurant (QSR) chains across Europe. By analyzing sales data from New Year’s Eve (NYE) and New Year’s Day (NYD), QSR chains can gain valuable insights into consumer behavior and ordering patterns, offering strategic guidance for tailoring operations and marketing.

“The Munchies”—a term that captures the emotional satisfaction derived from eating—is the intense craving for indulgent, typically unhealthy foods like fast food or greasy snacks after a night out. In fact, 37% of Domino’s overall sales occur after midnight.

Examining the sales data from different European regions reveals distinct consumer behaviors, some regions saw record-breaking sales on New Year’s Eve, while others on the first day of the year.

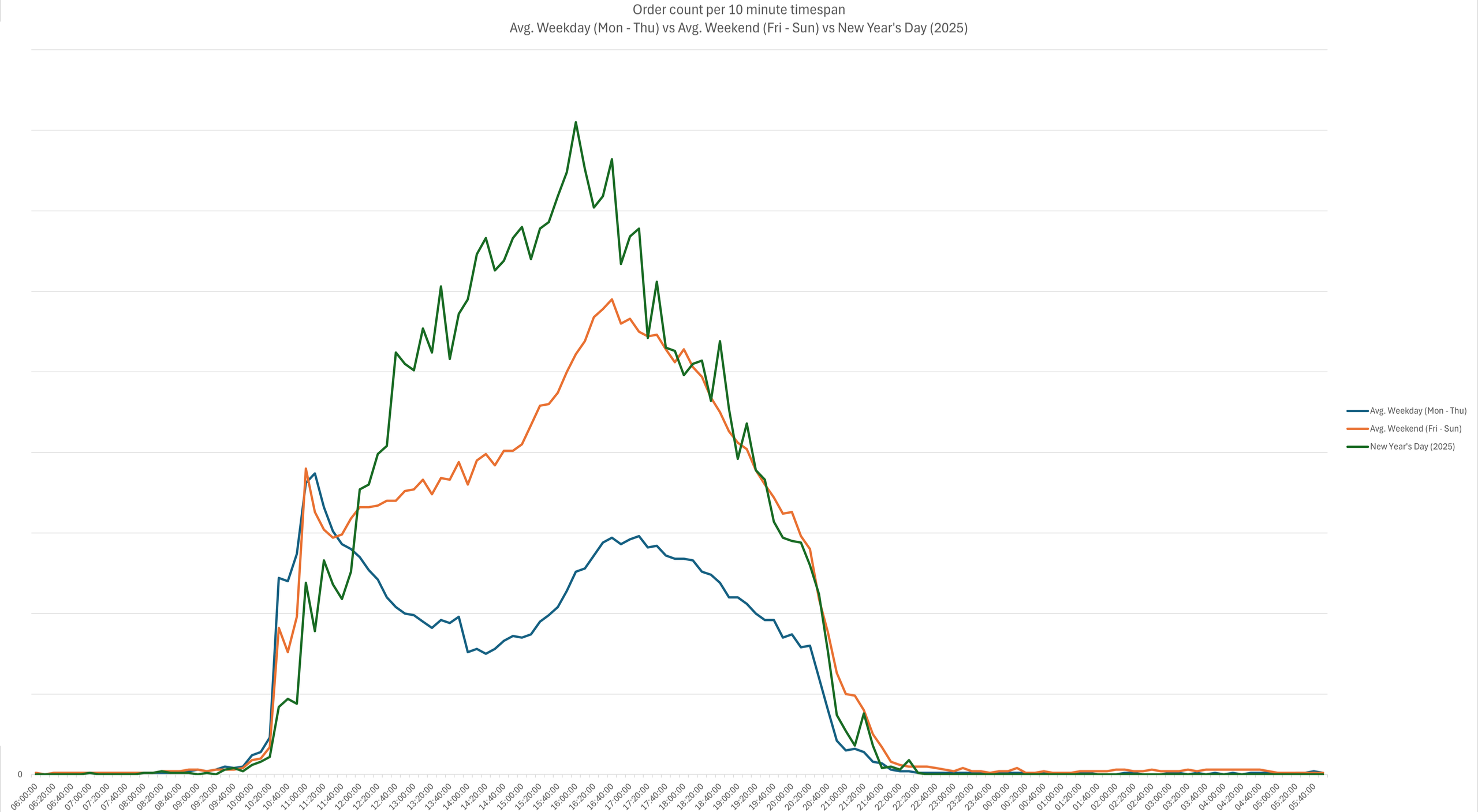

[Figure 1. Indicative representation of New Year’s Day Sales in Northern European chains]

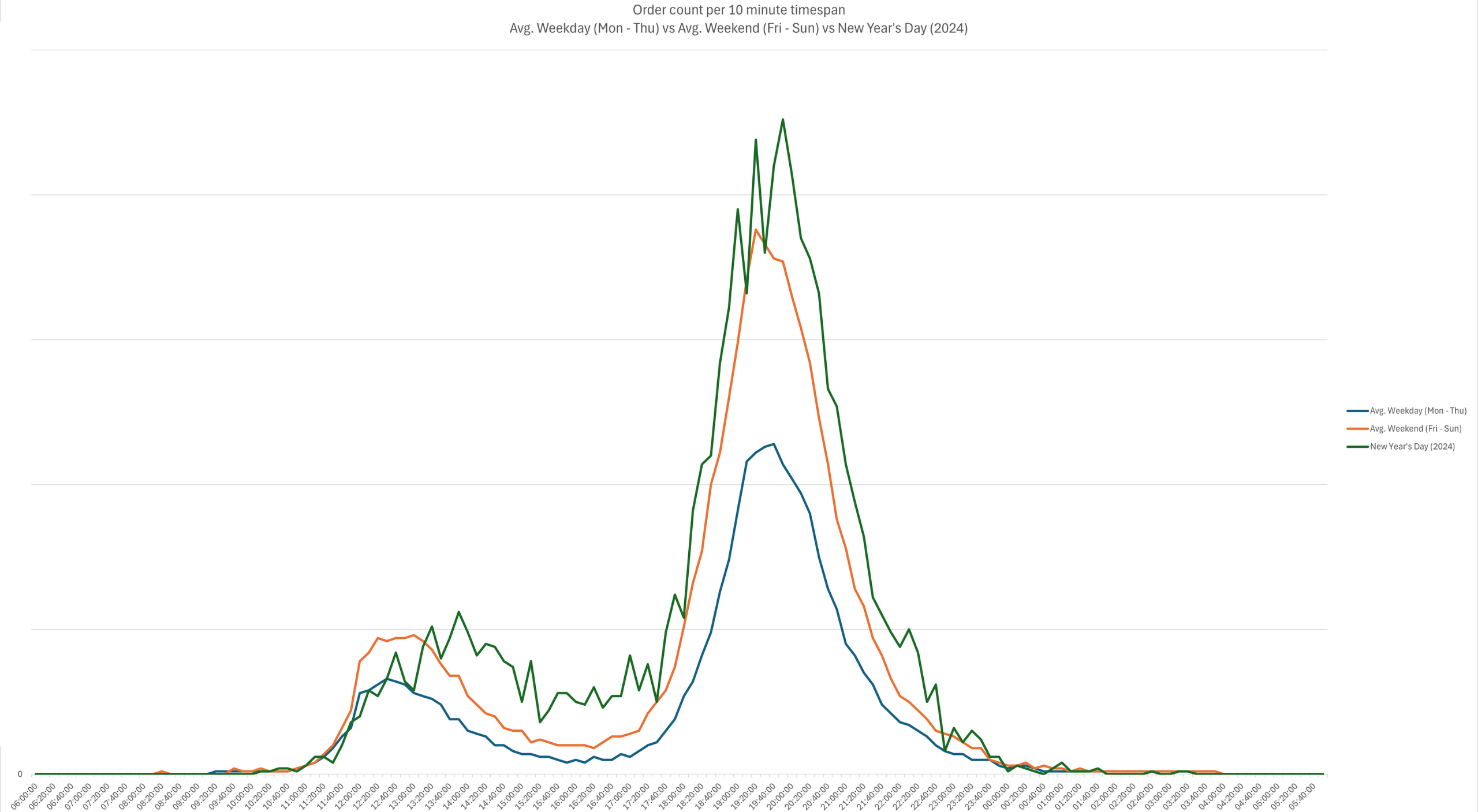

[Figure 2. Indicative representation of New Year’s Day Sales in Southern European chains]

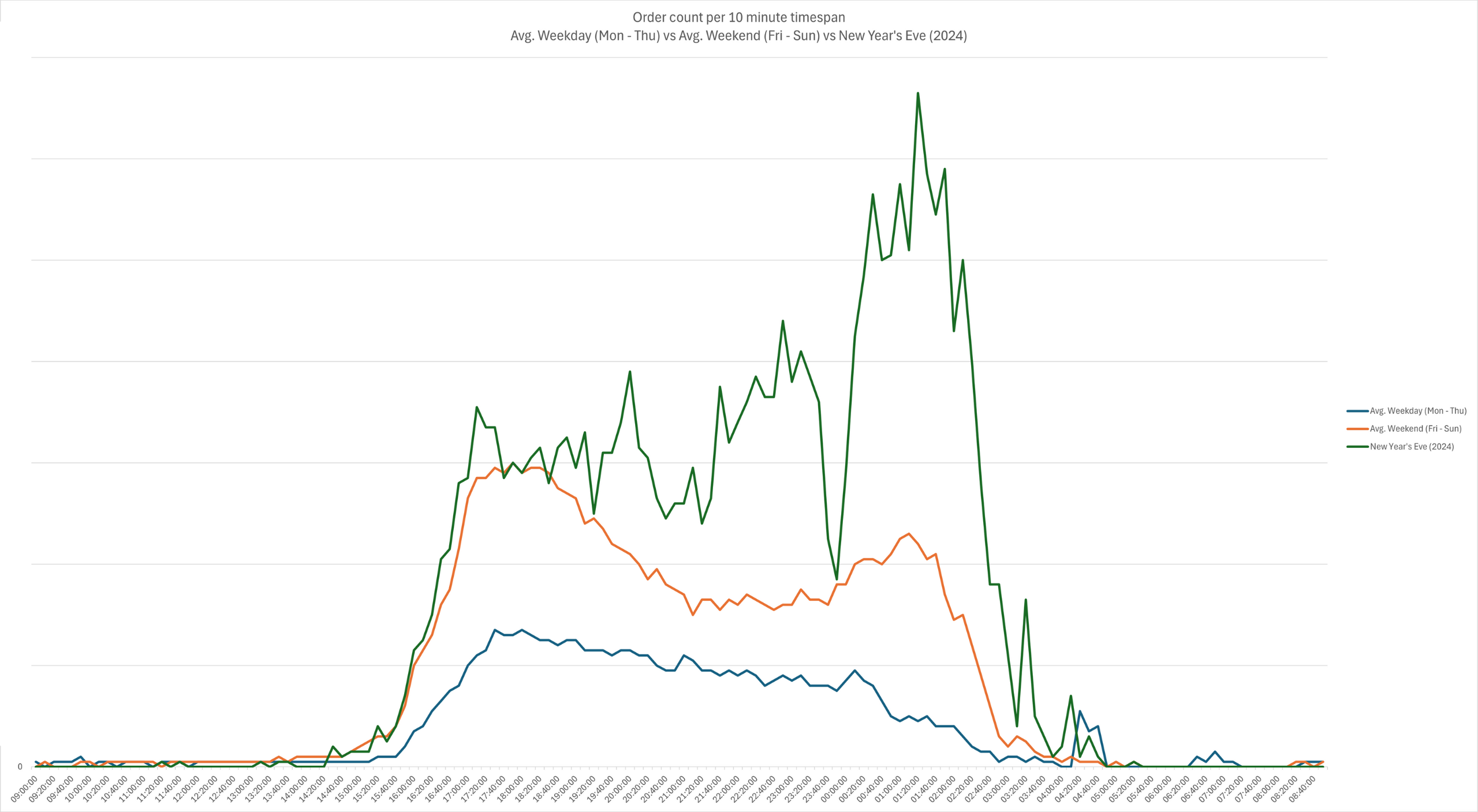

[Figure 3. Indicative representation of New Year’s Eve Sales in (North)Western European chains]

[Figure 3. Indicative representation of New Year’s Eve Sales in (North)Western European chains]

Some chains chose to close their QSR locations during the holidays. While this decision might align with cultural or operational preferences, it leads to missed opportunities to capture the heightened consumer demand.

These peak periods are when systems are most prone to outages due to the increased traffic and operational strain. A critical factor that could be contributing to remaining closed for the busiest days of the year is system outages. These downtimes can have a severe impact, resulting in lost orders, frustrated customers, and revenue dips when the stakes are highest.

Having a reliable and robust system is essential. With a stable infrastructure in place, QSR chains can confidently embrace the high-demand days. At S4D, we ensured 100% uptime for all our partners during these critical periods, enabling them to achieve record-breaking sales.

With such diverse consumer habits across European markets, how can QSR chains that eye multinational expansion strategize? Is it about creating tailored experiences for each market, or finding a universal appeal that resonates across borders?

At S4D we specialize in offering tailored digital solutions that drive localized success while ensuring operational efficiency across locations.